If you already know what tax form 5471 is, then you know how complex this tax information tax form can be. With the IRS putting the magnifying glass to international transactions and foreign corporations in respect to U.S. persons, this form 5471 encompases most aspects of international tax law into 1 form (with 7 possible schedules and 7 separate schedules). That is why the IRS has made an extensive form 5471 instructions spanning 35 pages to give you an insight on the requirements of this form and an idea on how to go about filing it.

Form 5471 Instructions

As described by the IRS, the purpose of form 5471 is “used by certain U.S. persons who are officers, directors, or shareholders in certain foreign corporations…” for certain reporting requirements and amounts relating to international tax law. The form 5471 instructions as laid out by the IRS defines the criteria for each category of filer (5 in total) and the requirements for each. It also describes the exceptions to filing, when to file, how to file, required form 5471 schedules, possible penalties, and instructions for each section of the tax form.

You would need to gather and provide certain information about your company, such as its share structure (or capitzalition cap), income statement, balance sheet, E&P statements, any possible shareholder/director loans and distributions & dividends during the year.

However it’s important to note that even with the IRS form 5471 instructions (and estimated 32 hours to complete this form), you would need extensive knowledge of international tax and categorization of foreign income, foreign tax credits, PTI (Previously tax income), Accumulated Earnings & Profits, etc.)

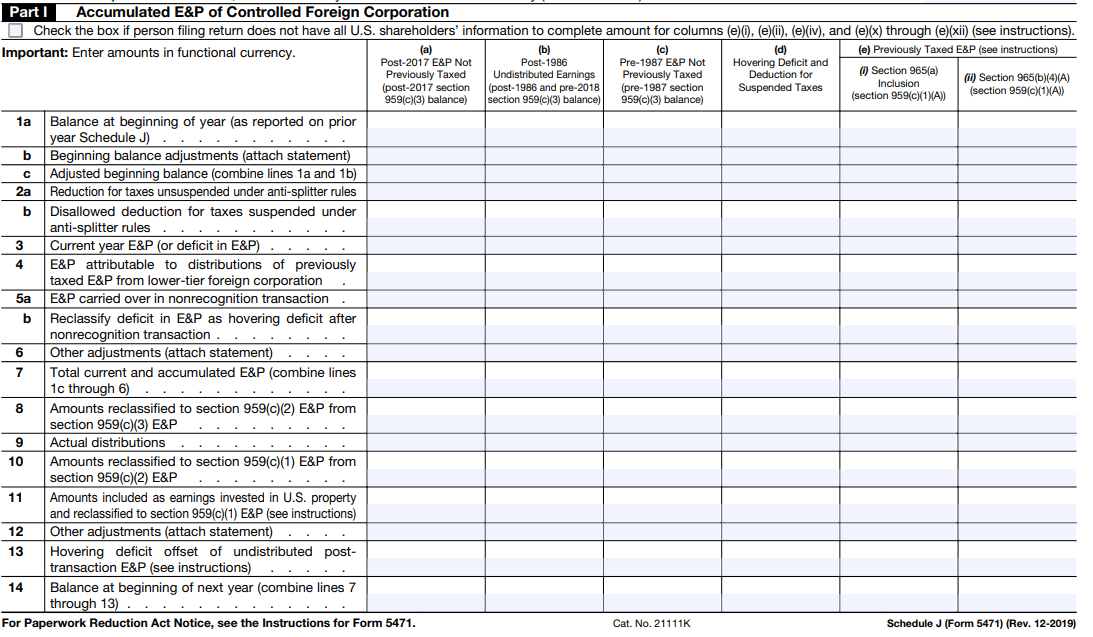

Here is a snapshot of Separate Schedule J (2019) for filing Accumulated Earnings & Profits:

Ref: IRS

Thus while the instructions for form 5471 from the IRS serve as an important guide for this tax form, in the end it would be better to seek advice from a tax professional on filing this form.

Category of Filers

The first step to tackling this complex tax form is identifying which type of category filer you are. This is a crucial step as it will not only determine what schedules (and how many) you need to file, but also if you qualify for any filing exemptions depending on your category.

Check out our convenient online form 5471 tool to help you identify which category of filer you are.

Category 1 filer

A category 1 filer is a U.S. shareholder of a foreign corporation that is a section 965 specified foreign corporation (SFC) at any time during any tax year of the foreign corporation, and who owned that stock on the last day in that year on which it was an SFC.

Category 2 filer

A category 2 filer includes a U.S. citizen or resident who is an officer/director of a foreign corporation in which a U.S. person has acquired 10% stock ownership in the foreign corporation or acquired an additional 10% of more of the foreign corporation’s stock.

Category 3 filer

A category 3 filer is a U.S. person who acquires stock in a foreign corporation which, when added to any stock owned on the date of acquisition, meets the 10% stock ownership requirement with respect to the foreign corporation;

Category 4 filer

A category 4 filer includes a U.S. person who had control (over 50% stock ownership of the voting power/value) of a foreign corporation during the annual accounting period of the foreign corporation.

Category 5 filers

A category 5 filer includes a U.S. shareholder who owns stock in a foreign corporation that is a CFC at any time during any tax year of the foreign corporation, and who owned that stock on the last day in that year on which it was a CFC.

The type of category the U.S. person falls under (individual or corporation) would determine the filing requirements and what information they must provide.

Exceptions form Filing

Depending on which type of category filer you are, you may apply for certain exceptions from filing form 5471. Most of these exceptions involve U.S. persons not owning any direct or indirect interest in the foreign corporation, having a foreign corporation controlled by another FC, or joint filing among many U.S. shareholders.

Form 5471 Schedules

Form 5471 consists of 4 pages with 7 different schedules and 7 separate schedules. The amount of schedules needed to be filed varies with the information of your company and category of filer you fall under. For instance dormant companies only need to file a few sections on Page 1 of form 5471, whereas category 4 filers need to file 6 schedules and 6 separate schedules as well.

The schedules in form 5471 consist of:

- Page 1: Company information

- Schedule A: Stock of the Foreign Corporation

- Schedule B, Part 1: U.S. Shareholders of Foreign Corporation

- Schedule B, Part 2: Direct Shareholders of Foreign Corporation

- Schedule C: Income Statement

- Schedule F: Balance Sheet

- Schedule G: Other Information

- Schedule I: Summary of Shareholder’s Income Form Foreign Corporation

- Separate Schedule E: Income, War Profits, and Excess Profits Taxes Paid or Accrued

- Separate Schedule H: Current Earnings and Profits

- Separate Schedule I-1: Information for Global Intangible Low-Taxed Income (GILTI)

- Separate Schedule J: Accumulated Earnings & Profits (E&P) of Controlled Foreign Corporation

- Separate Schedule M: Transactions Between Controlled Foreign Corporation and Shareholders or Other Related Persons

- Separate Schedule O: Organization or Reorganization of Foreign Corporation, and Acquisitions and Dispositions of its Stock

- Separate Schedule P: Previously Taxed Earnings and Profits of U.S. Shareholder of Certain Foreign Corporations

Steps to filing form 5471

While the bulk of the work for filing form 5471 would be done by your tax account or tax lawyer, there are some steps you can take to streamline the process and possibly lower the time/fees required to file this tax form.

The general steps to filing form 5471 include:

1) Gather the basic information about your foreign company, especially the financial statements (Profit and Loss, Balance Sheet, Earnings and Profits, information for distributions/dividends), as well as a complete picture of your company’s share structure and movements. If you don’t have a good system in place to track your company’s shares, checkout the free online equity management tool Eqvista. It helps companies record and track their shares, allowing the data to be easily shared with lawyers & accountants.

2) Find out what category of filer you are, and if you fall under any of the Exceptions from Filing Form 5471. Go to our online form 5471 tool to find your category.

Note it’s highly suggested to double check the results with your tax accountant/lawyer when filing the form, as this tool does not replace professional tax advice.

3) If you fall under a category and must file form 5471 (do not qualify for the filing exemptions), start looking for qualified tax professionals to help you file this form.

Note: Form 5471 is one of the most complex IRS tax forms out there, so many normal tax accountants in the U.S. may not be aware of this form, nor have knowledge to file it. Therefore due your due diligence when searching for a qualified tax professional.

4) Find out if there are other informational tax forms & tax returns you need to file. Depending on your foreign income and transactions, there may be numerous other related tax forms you need to file (for instance form 1118, form 2255, form 5472, and form 893 to name a few). You should do some basic research on these tax forms and consider your options for filing a tax provider at a reasonable price to help you stay in compliance with the IRS.

5) Follow up with your tax professional and have the relevant tax forms properly filed to the IRS.

Conclusion

Now that you have a better understanding of the form 5471 instructions and what steps you should take to file this tax form, its not too early to start gathering all your documents and approaching tax providers to help you stay compliant. Tackling this complex tax form (and possible other related tax forms) may take time, so its better to get a head start before tax season comes around. If you need more information about form 5471, contact us.

And if you need help managing your foreign company’s shares, checkout this online share management software at Eqvista.

Are you interested in tax form 5471?

Form 5471 is a complex IRS tax form to record share ownership in foreign corporations.