What is a Dormant Foreign Corporation?

A dormant foreign corporation is a type of company which exhibits very minimal operations during a given tax year. This type of dormant company also has minimal foreign assets, activity and no distributions to the US shareholders. Having this classification of a dormant foreign corporation comes with it a very limited informational tax filing if meeting all the requirements.

This must fit the requirements under IRS Revenue Procedure 92-70 to be classified as dormant. If the company can fulfill all the stated requirements, it can file a summary filing (ie. No extra schedules), which consists of information about the foreign corporation on Page 1.

Meeting these conditions is based on facts/activities of the company , so be careful to read and understand each before moving on to undergo a summary filing. It’s important that

The 8 specific conditions, which ALL must be meant to be considered as a dormant, are:

- The foreign corporation conducted no business and did not own stock in another corporation other than another dormant foreign corporation.

- The foreign corporation shares (other than the directors’ qualifying shares) were NOT sold, exchanged, redeemed, or otherwise transferred. Also, the foreign corporation was not party to a reorganization.

- The foreign corporation assets were NOT sold, exchanged, redeemed, or otherwise transferred, except for minimis transfers (further detailed in points 4 and 5).

- The foreign corporation received or accrued $5,000 or less of gross income or gross receipts.

- The foreign corporation paid or accrued $5,000 or less of expenses.

- The value of the foreign corporation’s assets were less than $10,000, as determined pursuant to the US GAAP (but not reduced by any mortgages/ other liabilities).

- No distributions were made by the foreign corporation; and

- The foreign corporation either had no current or accumulated earnings and profits or had only de minimis changes in its beginning and ending accumulated earnings and profits balances by reason of income or expenses specified in 4 or 5 above.

If the company can fulfill all 8 requirements as stated above, it can be classified as a dormant foreign corporation, and proceed with the summary filing. Even if you fulfill most, but not all of the requirements, you may be qualified as a non-dormant company and be required to file as normal.

For example, if you own a foreign corporation which had less than $5,000 in sales and $5,000 in expenses, below $100,000 in foreign assets and made no distributions (dividends) to the company shareholders, but transferred shares/redeemed or acquired shares in another active company, then this company would not qualify as a dormant foreign company. Thus this may not apply for most holding companies, as they often hold shares in another active company or undergo numerous share transfers during the year.

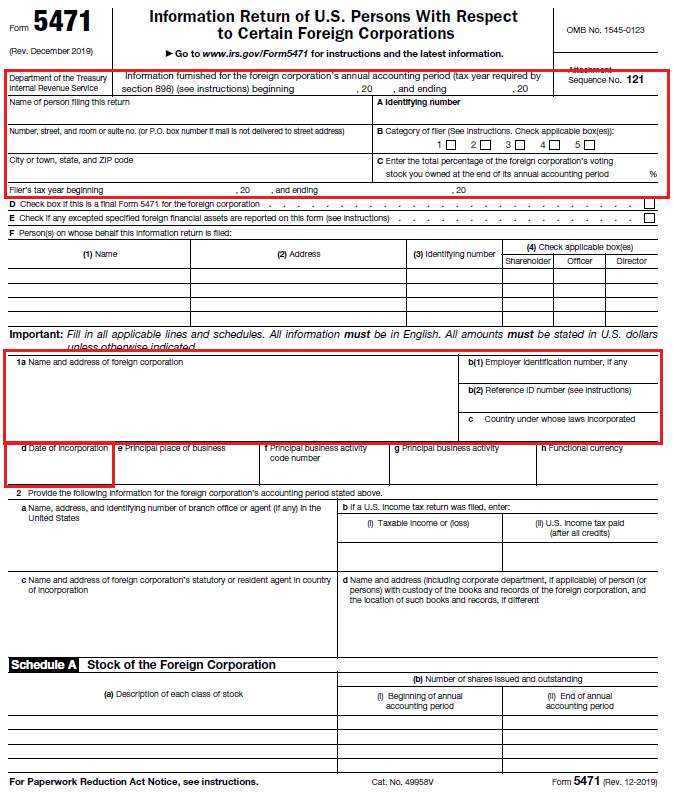

The summary filing consists of Page 1 of Form 5471 (including the tax year, name & address, category of filer, % of foreign corporation stock holding) which covers Items A-C, and Items 1a-1d. You must also label on the top margin of the summary return “Filed Pursuant to Rev. Proc. 92-70 for Dormant Foreign Corporation”. This summary filing would be sent together with your income tax return, as well as file a copy of this summary return to the IRS center in Philadelphia, PA.

Here is how the sections of the summary filing would look (Form 5471 taken from IRS website):

Even though this is a greatly reduced information related tax filing due as being a dormant foreign corporation, the filer would still need to identify which category filer they are and their total percentage of voting stock they owned in the foreign corporation at the end of the accounting period. Errors in filing in this information could lead to possible form 5471 penalties.

Conclusion

Now that you have a better understanding of what dormant foreign corporations are and the 8 requirements for each of these companies, you may be able to determine if you company can classify as one. However always take this advice of a tax professional when dealing with form 5471 as some details may have been overlooked. If you need more information about form 5471, contact us.

And if you need help managing your foreign company’s shares, checkout this online share management software at Eqvista.